Research, editing : Gan Yung Chyan, KUCINTA SETIA

News on Laos, CCP

News (1)

Another country "exploded"! Economic collapse, national anger: get out...

Source : Aboluowang / https://www.aboluowang.com/2022/0624/1766700.html

Public anger against the leader of the one-party state erupted like a volcano shortly after an article in Lao titled "Laos Economy Collapses" appeared on Radio Free Asia's Facebook page in June 2022.

The post, which received more than 1,100 responses, included angry rants from Laotians. Although the replies were easy to track, the anger was unstoppable. One woman who posted said angrily, "If the government can't manage the economy, get out!"

In Vientiane, the capital of Laos, this public outrage - evident on other social media platforms including Tik Tok and YouTube - has not gone unnoticed by seasoned observers. They see it as a rare act of courage by the public, who has long been forced to remain silent under intimidation by the Lao People’s Revolutionary Party.

"As the economic crisis is affecting their daily lives, people are losing their fear of public criticism," said an observer who asked not to be named. "In Laos' repressive political environment, social media is what they can do. The only way to do that."

An economic crisis has been brewing in recent months. The signs include long lines of cars at petrol stations in Vientiane and elsewhere, and surges in the prices of food and other necessities as the local currency, the kip, depreciated against the dollar.

In June, international rating agencies warned that Laos' economy was at risk of defaulting. The Lao economy has been running fiscal and current account deficits for years and is struggling with a liquidity and solvency crisis. Its level of crisis can almost be compared with the economic crisis in the South Asian country Sri Lanka. Sri Lanka announced in April that it has run out of dollars to repay its foreign debt this year.

The government's response to public discontent was also revealing, with key officials acknowledging a crisis in the $20 billion economy. Lao Prime Minister Phankham Viphavanh is one of them. At the latest meeting of the Lao National Assembly last week, he candidly revealed that he is aware of the criticism on social media.

Finance Minister Bounchom Oubonpaseth was equally candid about the mounting pressures on the impoverished country of 7.5 million. On Monday, he told members of the National Assembly that the country had accumulated huge debts due to "the huge loans it took for the development of the country from 2010 to 2016". Annual foreign debt service will increase from $1.2 billion in 2018 to $1.4 billion in 2022, he said. "In 2010, our external debt service was only $160 million, which could be paid from domestic revenue."

In May, a senior central bank official said that only 33 percent of the country's export earnings had re-entered local banks as of the end of April, preventing the country from building up enough foreign exchange reserves to pay for imports and repay foreign debt. The main foreign exchange earnings come from the sale of hydropower projects to neighbouring countries, mining and agricultural products.

Toshiro Nishizawa, a professor at the University of Tokyo, believes this official candor is selective after facing "enormous and worrying" financial challenges but Nishizawa, who was a policy adviser to the Lao government, said the official warnings were "formula, presupposed and generalized". He does not expect key economic and financial indicators to be released immediately "due in part to political sensitivities and capacity constraints."

Analysts say that the economic crisis triggered by a series of external crises could shake the country’s foundations of rule: the 2020 covid epidemic has hit the country’s tourism revenue hard while the Russia-Ukraine war has pushed up oil prices. These factors make the local currency weaker against the dollar, making imports more expensive.

Sonexay Sitphaxay, the governor of the Lao central bank, was dismissed this week, signaling the panic has begun. He was replaced by former Deputy Finance Minister Bonleua Sinxayvoravong.

Signs of a recession are already evident. International agencies such as the World Bank and the International Monetary Fund had warned Laos before the outbreak that the country was heading for a foreign debt crisis as its foreign exchange reserves dried up.

In August 2019, the International Monetary Fund noted following Article IV consultations on the Lao economy, “The large current account deficit, low levels of reserves, high levels of debt, managed exchange rates and a dollarized banking system magnify the Macro Vulnerability."

According to the World Bank, the country's public debt has soared to 88% of Gross Domestic Product (GDP) by the end of 2021, with external debt estimated at $14.5 billion. China's list of foreign creditors includes Chinese creditors, accounting for 47%, reflecting Laos' close relationship with China. Over the past decade, China has become Laos' largest creditor, investor and trading partner. In addition, Laos owes 11% of its total debt to China in bilateral loans.

The World Bank and Asian Development Bank together accounted for 17%, international sovereign bonds accounted for 17%, and non-concessional loans accounted for 8%.

The World Bank said Laos has an estimated foreign debt of $1.3 billion to be repaid annually through 2025. For a country with comparable foreign exchange reserves, this is a formidable challenge. Following this, Moody's Investors Service downgraded Laos by one notch this month, from Caa2 to Caa3. Fitch Ratings maintained its CCC rating, which it reaffirmed in August 2021 but noted "the possibility of default".

“Laos’ room to obtain external funding to service its debt has narrowed,” said Jeremy Zook, head of sovereign ratings at Fitch in Hong Kong and chief Lao analyst for Laos. "The country has a lot of bilateral and multilateral payments to make this year, almost half of its total debt service, along with some smaller bond payments and syndicated loans."

Still, Lao government authorities are not ready to openly discuss the dilemma with friendly neighbours such as Thailand. Thailand is a major source of Laos imports and a major buyer of Laos’ hydropower exports. When the Lao Prime Minister visited Bangkok in early June, he did not mention the debt issue.

A source in Thailand’s prime minister’s office who witnessed the talks said, “We were aware of the issue but it was not mentioned in their official talks. There was little sign that they were facing debt problems and needed some financial aid. Nothing. Mention. Keep your mouth shut."

News (2)

Harbin man deposited 460,000 RMB into "Alipay" but couldn't get it out. Customer service: Wait for 1,083 days, citizen's confidence in the financial system has been shaken

Editor : Liu Shiyu / https://www.aboluowang.com/2022/0623/1766416.html / Image of Mr Yu : Web Screenshot

Recently, the cash liquidity of China's financial system has attracted much attention. Several banking institutions have reported restrictions on the daily withdrawal limit. The latest situation is that the wealth management product "Yu'e Bao" under "Alipay" also has similar problems. Mr. Yu, a citizen of Harbin City, Heilongjiang Province, deposited his 460,000 RMB savings into "Alipay", but when he wanted to withdraw money recently, he was unable to do so. The customer service said that it would take nearly three years to withdraw the money. Mr. Yu communicated with the customer service of "Alipay" for many days to no avail. He sought help from the media and complained to the regulatory authorities. The problem was finally resolved.

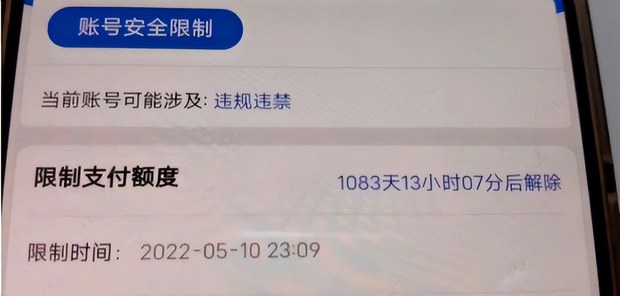

According to Chinese mainland media reports, Mr. Yu deposited 460,000 RMB in "Yu'ebao" under "Alipay". When he wanted to withdraw the money to pay off the mortgage, he found that he could not withdraw the money. The reason is that the account "may be involved in violation of laws and regulations", and it will take 1083 days, that is, nearly three years, to be released. In addition to being unable to repay the mortgage, Mr. Yu had to borrow from friends for his daily expenses, which made life extremely inconvenient.

Image : Mr. Yu's "Alipay" account page shows that the reason for the inability to withdraw cash is that the account "may be involved in violations of laws and regulations", and it will take 1083 days, that is, nearly three years, to be released. (Screenshot of web video)

"Alipay" responded that Mr. Yu's account was restricted due to the abnormal transaction behavior of his account based on the reporting information and the platform's risk system identification. In order to avoid losses caused by its account being used by criminals, "Alipay" needs to verify whether its account is involved in online gambling, telecommunications fraud and false transactions, so it has temporarily restricted it. After the man called the customer service for feedback, and under the guidance of the customer service, he uploaded relevant supporting materials, and his account was lifted.

Image : Mr. Yu, a citizen of Harbin, Heilongjiang Province, deposited his 460,000 RMB savings into "Alipay". (Screenshot of web video)

Although Alipay has clarified, the concerns of Chinese depositors still linger. Recently, there have been frequent reports of problems with cash flow in China's financial system. There are various "conspiracy theories" circulating in the society. Some people are worried that their hard-earned money in the financial system will be misappropriated. Confidence has begun to show signs of shaking.

No comments:

Post a Comment